Commercial Auto Insurance Made Simple

Insurance doesn’t have to be complicated. Not even Commercial Auto Insurance. If you have a business with vehicles in North Carolina, no matter if they are cars, trucks, or vans, you have to have business auto coverage.

But, as all business owners know, knowledge is power. Knowing something that your competitors don’t can be the difference between success and failure.

But you know that. That’s why you’re here.

Figuring out Commercial Auto Insurance and knowing what it is, what you need, and how to get it can be a big help for your business.

So let’s go through the things you NEED to know to ROCK Commercial Auto Insurance and help your business thrive.

How Commercial Auto Is Like Personal Auto

It’s a farm vehicle.

Luckily, there are many similarities between Commercial Auto Insurance and Personal Auto Insurance in North Carolina. Odds are you’re pretty familiar with personal auto (and if not check out this Guide).

But how exactly are they similar?

To start, commercial auto insurance has two basic coverage forms that are the same as personal auto: liability coverage and physical damage coverage (what most people refer to as comp and collision).

Liability Coverage – Just as in personal auto, liability protects your business from accidents and lawsuits caused by the actions of you and your employees. If someone representing your business is driving a work vehicle and causes an accident or other damage, this coverage helps to protect you by reimbursing damages or paying for court costs.

Remember, liability covers the damage that you do to others, not to your own vehicles.

Bodily Injury Liability – This covers injuries, sickness, or other medical conditions that can arise from you causing an accident. If you hurt someone this can pay for medical bills, hospital stay, and even lawsuits that come from their injuries.

Property Damage – Covers damage that you or your employee drivers cause to another person’s property. If your careless delivery driver runs over someone’s mailbox, this is what covers it.

Liability is of the utmost importance in Commercial Auto Insurance, as people may feel differently about suing a business instead of an individual. Looking someone in the eyes and taking them to court may be tough, but suing a “company” is sometimes seen as a harmless way to make money.

What about the actual physical part of the car, though? The two coverages below cover your business vehicle.

Collision Coverage – Collision comes to your rescue when you have damage to a vehicle owned by your business that was caused by colliding with something, usually another vehicle.

Comprehensive Coverage – This coverage protects your business vehicles that have been physically harmed – as long as that damage was not caused by a collision. Things like theft, hitting an animal, or or cracking your windshield are all classic Comprehensive claims.

This basic framework gives you protection from accidents that you cause or that can happen to you. The coverages also protect you from damage to vehicles and damage to people or property.

But all of this is pretty much the same as North Carolina personal auto, right?

So what’s different?

How Commercial Auto Is Different Than Personal Auto

Delivery or bust.

The biggest difference in terms of looking at your policy and understanding it is this: commercial auto symbols.

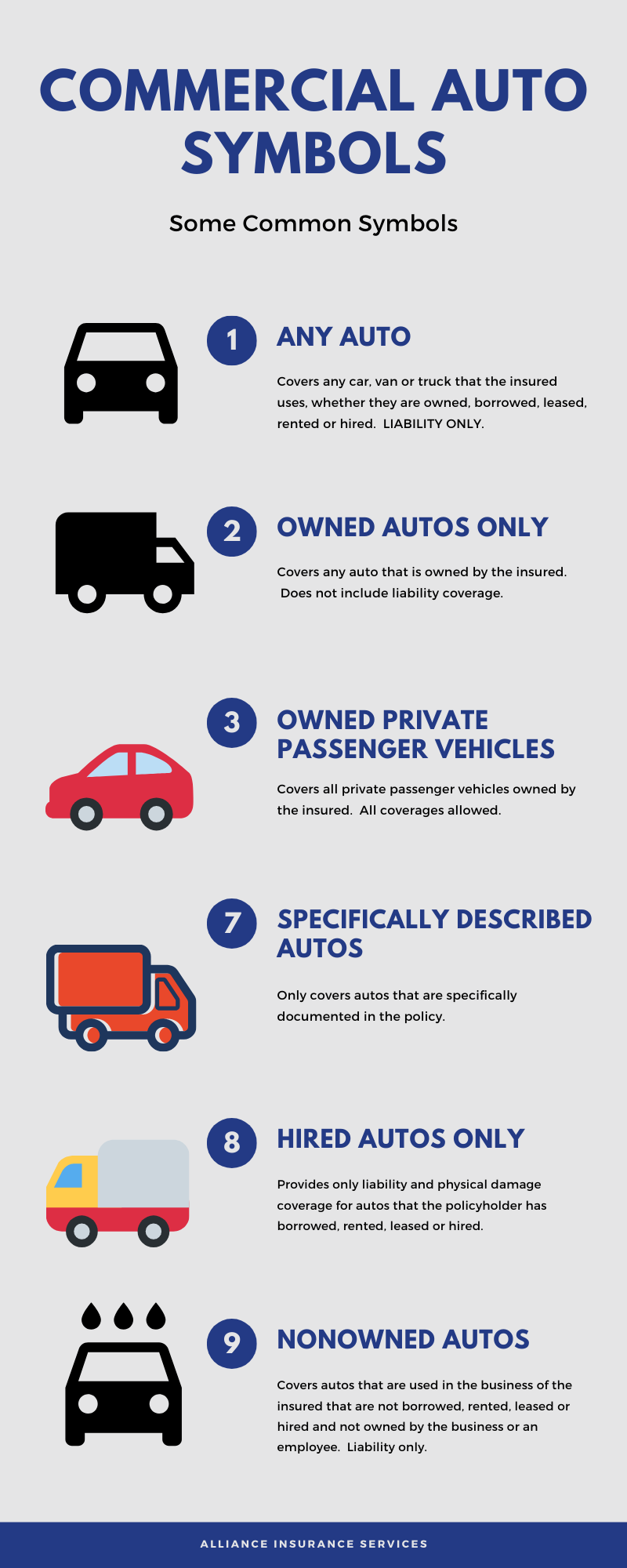

Symbols are a way for insurance companies to categorize different kinds of ways that businesses can use their cars, trucks and vans.

A symbol is just a number that represents a particular way of using vehicles.

Sound confusing? Look at this chart to see an idea of some popular commercial auto symbols.

REMEMBER: The number is the symbol, so 1, 2, 3, etc are the symbols.

As we can see from the chart above, the kind of business you have and how you use business vehicles determines your auto symbol.

NOTE: This is not a total list of all symbols but a sample to show you what symbols are and how they are used.

So, as you can tell, one of the major differences between your personal vehicle insurance and your business auto insurance is that different ways of owning and using vehicles for your shop, sales job, dealership, delivery service, transport company or even your brewery have different coverages they can have and different rates.

Good news for you North Carolina businesses: YOU DO NOT HAVE TO MEMORIZE THIS! Your agent will figure out what your symbol is and you can focus on running your business.

But knowing that there is a difference can go a long way to you knowing what to expect. And if you branch out or start a new business, you can be confident that there will be a new auto symbol for your new venture.

Extra Coverages for you Business Vehicles

The symbol I would use is !

There are additional ways that you can keep your North Carolina business safe from accidents with coverages that aren’t mentioned above. Let’s see what they are.

Commercial Excess Liability Coverage – This is a product that provides extra, or excess, liability coverage that starts when your commercial auto liability ends. For example, if a driver of yours hits a family while making a delivery and there are fatalities, the costs after medical bills and legal fees can go into the millions. A basic liability limit may not be enough to cover this, leaving your business on the hook for the rest. With Commercial Excess Liability, whatever is left over after your primary policy pays would will be covered by this coverage. Also called a Commercial Umbrella policy.

Commercial Crime Insurance – Automobiles are expensive pieces of equipment, and are regularly targeted for theft. Commercial Crime Insurance coverage helps to add additional protection against crime that may not be totally covered by your Commercial Auto Insurance. Adding this to your list of protections can make sure you are completely safe against burglary, robbery, theft and even employee related incidents.

Make sure you have the right coverage.

Now that you know what it is your North Carolina business needs, you need to make sure you’ve got what you need.

Ask for a quote from Alliance Insurance and get the best help available with people who specialize in commercial auto insurance. Having the right policy with the right coverages can be the difference between your business surviving an accident or letting an accident put you out of business.

Click on the link below and let’s get started putting you where you need to be to succeed. After all, you’ve done all the hard work of getting your business where it is today.

Let’s help you keep it there.