Real Estate Insurance FAQ’s by Chase Smith

Meet Chase! Chase is our real estate insurance specialist. Chase has a wealth of knowledge in the real estate area and works frequently alongside mortgage brokers, commercial investors, property management owners, industrial property owners, and more. Check out the video below! Protect your investment with the right coverage. When you own commercial real estate in […]

How High Building Costs Affect Your Insurance

Building Costs are Through the Roof If you own a house, townhouse, condo or rental property, you have heard the news: building costs are at an all time high. The housing market is red hot, with low inventory of available homes pushing many to buy whatever is available rather than wait. Home builders are ramping […]

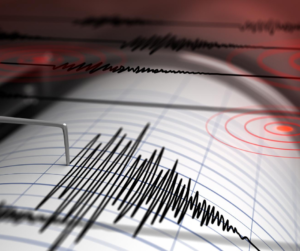

What To Do in an Earthquake

What Should You Do if an Earthquake Hits? No one wants to experience an earthquake. But these ground-shaking disasters can happen at any time, and in places where you never thought possible. But what if, like most of our clients, you live on the East Coast? What if you’re a proud Midwesterner? Why should you worry […]

Why We Wouldn’t Insure the Tiger King (and Other No-No’s)

Sorry, Future Tiger King… You’re On Your Own Lions and tiger and bears… no thanks. There are some things an insurance agent will NOT be able to insure (like the Tiger King), and this light-hearted blog will cover a few of them. So join me as I go over things you will laugh at, some […]

Work From Home Cyber Security Tips From a Hacker

More People Work From Home – And That Could Be Trouble Times have changed, and more and more people are having their employees work from home. Some of these changes have been forced, while others simply made sense for that particular business or employee. In some ways, this is great news. It frees up businesses […]

How Much Does It Cost To Insure A NASCAR Car?

Wait, you guys insure NASCAR? NASCAR? Okay, not really. But we LOVE cars. We built this business on writing auto insurance, and we write garage insurance for auto dealers, auto body shops and mechanics better than just about anyone in the business. So we know something about insuring cars. But what if you had a […]

Distracted Driver Awareness Scholarship

We Know the Impact of Distracted Driving For those of us at Alliance Insurance, we know just how devastating distracted driving is to families across the United States. In fact, we have firsthand experience of losing a loved one to this terrible trend. But saying that something is bad isn’t the same thing as seeing […]

3 Risks That Could Cost Your Bar Green This Saint Patrick’s Day

Stay Lucky this Saint Patrick’s Day, My Friends. For many bars, Saint Patrick’s Day is the pot of gold at the end of the rainbow. It offers crowded, thirsty customers who want to drink you out of house and home – a prospect that would terrify you at your own house but is a fantastic […]

Common lawsuits employers face today.

No one thinks they will be in a lawsuit. “It will never happen to me.” That’s what so many business owners today think when they hear about employees taking their bosses to court. The vast majority of small business owners, entrepreneurs, managers and leaders genuinely believe that the chances of being sued by an employee […]

It’s Time to Get Real About Flood Insurance

You’re in denial about Flood Insurance. There, I said it. Flood insurance is the most overlooked policy for homeowners in the entire country. It is the biggest gap in coverage that we deal with on a daily basis, and could easily be resolved with one simple, affordable, government-backed policy. So why? Why don’t more people […]