Do You Know Your Homeowners Insurance Cost?

You probably know a lot about your Homeowners Insurance. Most people are aware that it repays them if something damages their house, like wind or fire. It’s common knowledge that Homeowners Insurance is required by mortgage companies to get a house, so a lot of people have it.

But do you know, right now, off of the top of your head, how much it costs?

SPOILER ALERT: I give the numbers at the end of the blog!

BONUS ALERT: I give out ANOTHER FACTOR at the end end of the blog!

Do you know why it costs what it does? What factors make Homeowners Insurance more expensive? Less expensive?

Do you know why North Carolina is a great state for homeowners insurance – as long as you are in the WESTERN part? Do you know why the EASTERN part is harder to insure?

You’re probably thinking, “No, dude, that’s why I’m reading this.” And fair enough.

So let’s get started like this – if you don’t know anything about Homeowners Insurance at all, check out our Ultimate Guide to Homeowners Insurance first.

Go ahead. I’ll wait.

Read it? Good.

Now that you know your HO-3 from an HE-7, let’s get into what costs what and how much you can expect to pay to get some seriously great coverage in North Carolina.

Cost Factor 1 – Value of Your Home

This is probably the easiest thing to understand when it comes to North Carolina Homeowners Insurance pricing. If your house would cost more to rebuild, it will be more expensive to insure.

But, the key phrase above is REBUILD.

As I go over in detail in my blog on What Your Home Is Worth, your homeowners insurance policy is concerned with how much your house would cost to rebuild, NOT how much it would cost to buy on the open market.

That means that what your house is made of, how it is made and how much it would cost to rebuild it are the factors that help determine just how much it would be to insure your home.

Insurance is always about helping to restore you back to where you were BEFORE an accident occurred, and rebuilding your house (or repairing it) is the most basic example of this.

The most obvious way this is seen is the size of the house, the square footage. The larger the home, the more it would cost in materials to rebuild it. Pretty simple, right?

Materials also matter. If your home is made of wood and inexpensive vinyl siding, that shouldn’t be too big of a deal to redo. But if your home is made of hardie board, or stone? Things can get expensive quickly.

So when you’ve just bought a new house, and you’re furious that your homeowners insurance is twice what it used to be, don’t worry. It might have something to do with the fact that your new home is bigger, has brick and masonry walls, and a lovely architectural tile roof.

NOTE: Age of home is a factor. The older the home, the more expensive to rebuild. In insurance, the goal is to build it as it was. Rebuilding older homes and trying to use the same materials is often pricey.

Your 1,000 square feet, brick on frame ranch house in Pilot Mountain, North Carolina will be less expensive than your 1,700 square feet stone on frame mountain home in Asheville, North Carolina – no matter what company you are with.

So the rule of thumb: More expensive to rebuild, more expensive to insure.

Cost Factor 2 – Location

This also should make sense to most people. After all, what is the number one rule in real estate?

LOCATION LOCATION LOCATION.

Location affects your homeowners insurance premium in a few different ways. Let’s go over the three biggest ways location really matters.

First, the local area where your house, condo or townhouse exists has a rating called Protection Class. This rating reflects how easy it is for fire trucks and other emergency responders to get to your home and help you if there is an emergency.

It makes sense that the faster firefighters and others could come and help put out a fire, help someone that is hurt, or help prevent other kinds of damage, the lower the rate because your insurance company will be more confident that claims will be lower or less likely to happen at all.

Second, where your home is determines what kind of calamities or disasters could hit your house. If you live in the Midwest, you could be in the path of tornadoes. If you are in Florida, you could be subject to hurricanes. If you’re in California, you may find yourself in danger of earthquakes and wildfires.

The most obvious example of this is if you are in the coastal part of North Carolina. It will be obvious to everyone in the eastern part of the state that hurricanes and flooding dominate conversations about insurance coverage and cost.

If you’re near the Atlantic ocean in the Southeast, hurricanes are just a part of life. And as flooding becomes more and more common, this too is a factor (and why you should have flood insurance no matter where you live).

The third factor is the urban vs rural divide. This is more of a general rule than an absolute, hard and fast rule. But the gist of it is this: if you’re in a city, you are more exposed to certain risks than you would be in the country.

Houses are more vulnerable to fire since they are close together. Even in the safest cities crime rates for property crimes are usually higher. And more people means a greater chance that one of them will do something thoughtless and damage your property.

That being said, some cities are incredibly safe – shockingly so considering the press they get and what those cities used to be in the 70s and 80s. New York City, for example, has a lower crime rate than the national average.

While other cities are so spread out that they barely deserve the name in the outer reaches. Los Angeles, CA is 503 square miles, but has densely populated cities all around it. But Houston, TX is 669 square miles, and while it is surrounded by smaller suburbs it feels more like a giant Greensboro at times than a downtown Charlotte.

If you were curious, Charlotte, North Carolina comes in at a slender, elegant 297 square miles. But the traffic still stinks. (Sorry Charlotte, we love you!)

Cost Factor 3 – Claims History

If you’ve read any of our other blogs, you knew this was coming.

Having claims in the past is a sure fire way of paying more for your insurance, no matter what you’re insuring. A lot of people think that this isn’t fair. But look at it this way:

Let’s say you’re a mechanic who has agreed to fix the cars for two of your neighbors for a flat, monthly price. Each pays you no matter what happens, you work if something needs fixing, no worries.

Sounds great, right? Except one neighbor has problem after problem, while the other hardly ever uses your service. Charging them both the same seems wrong, doesn’t it?

That’s why insurance companies changes what insurance costs based on how much you “use” it (though using it isn’t the right term, since it’s used in an accident or emergency – and you don’t exactly plan those).

If you have a lot of claims, there tend to be reasons behind it. You can just be extraordinarily unlucky, of course!

But sometimes people who have lots of homeowners claims either don’t take care of the property, or act in reckless ways that invite accidents, or are just in terrible locations that have lots of natural occurrences that cause damage.

Regardless, insurance companies try to make money to be able to pay out on the claims they do have, while also staying in business to keep paying out claims in the future.

So, if you’ve had several claims and you wonder why your insurance premium is so high, all those accidents are probably your answer.

Real North Carolina Quotes

To prove to you that this stuff matters, I’ve got three real, honest to God quotes that show what I mean.

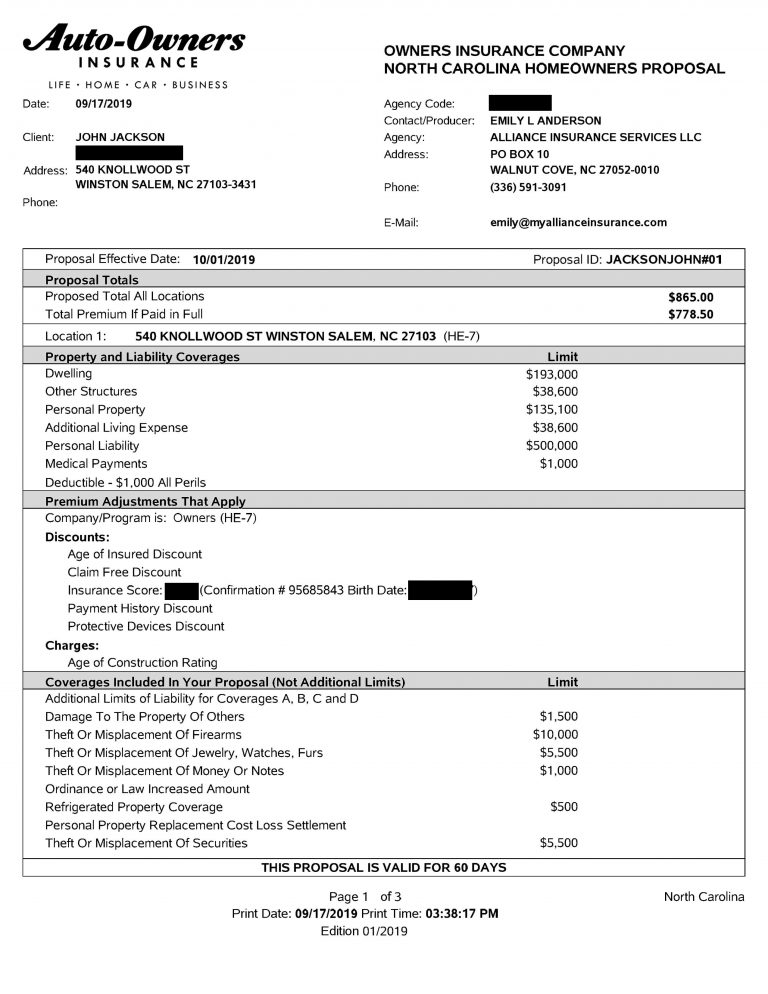

The first one is this:

In the (only slightly redacted) quote above you can see that in a home that would cost just under $200,000 to rebuild (check out Dwelling, that’s the coverage for the house itself) we will pay $865 a year for full reconstruction cost coverage on the home. That’s a stellar deal.

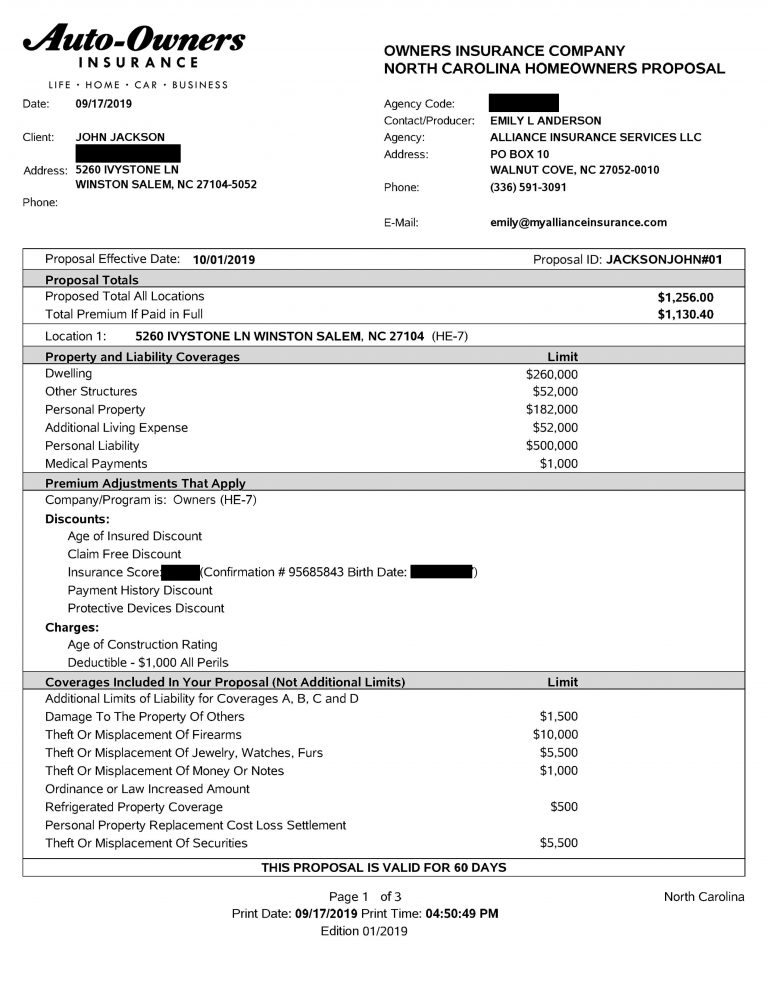

In the next quote we see a larger home that is more expensive to rebuild. We still have the older home price adjustment but we have discounts for claims free, insurance score (a hint about the last hint at the bottom of the blog), and Protective Devices discount – TIP: if you have a security system you get a discount!

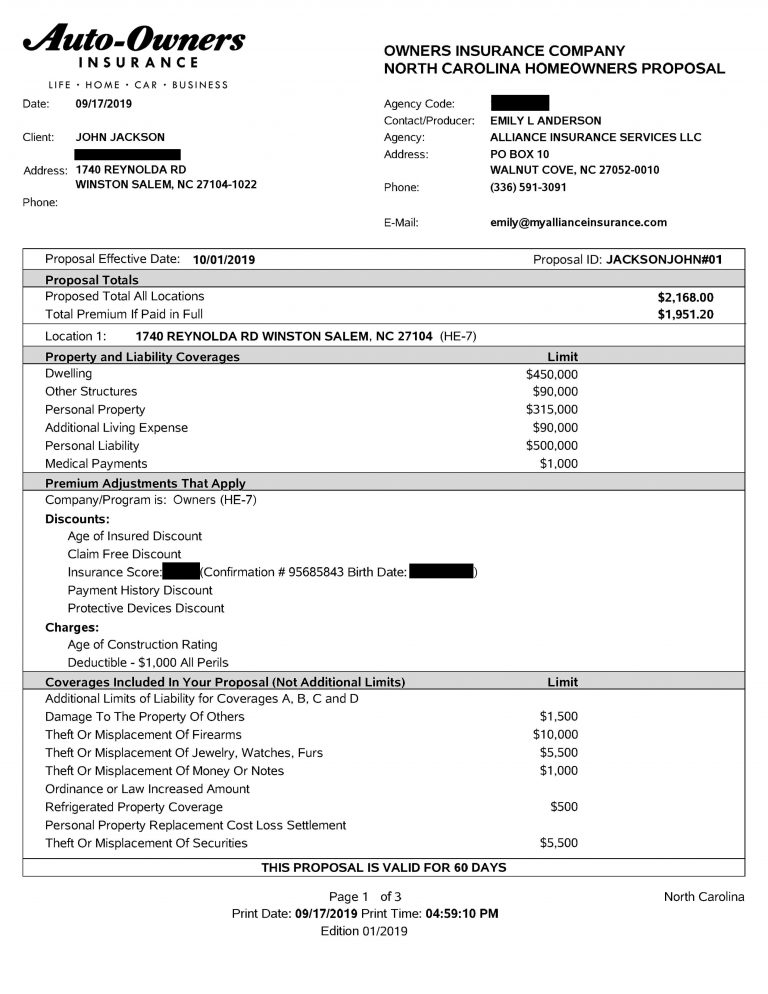

And lastly, the big boy. This policy insures a much more expensive home in terms of replacement cost, and the premium is a lot higher as a result. All the same price adjustments are there from the last couple of quotes, but the major this is the cost of rebuilding the home.

Now, for our last tip!

Credit is a major factor in determining price in North Carolina – or anywhere!

That’s right! Your credit score is a big part of how much you pay for homeowners insurance, whether you live in North Carolina or anywhere else.

Check out our blog on How Does Credit Affect Your Insurance Price and get wise to this very important piece to what you pay.

If you look at the quotes above, you can see “Insurance Score.” That number is based on your credit score and adjusted for each insurance company’s internal system. But if you see insurance score on your quote, you know what it is.

So what now?

You should know a lot more about why you pay what you do for homeowners insurance in North Carolina. To make sure you’re getting a great quote in this great state, double check with Alliance Insurance to see that you have the right coverage AND the right price.

Click the link below and let’s start the process of getting you taken care of like you deserve to be – like family.